Cook County Illinois Business Personal Property Tax . we've created tools for business property owners for valuations and property tax information. business personal property tax is based on a list of your assets. — the cook county property tax portal, created and maintained by the cook county treasurer’s office, consolidates information from the. However, not all states tax these assets in the same way. the department of revenue was established by the cook county board of commissioners in december 1992. welcome to assessor property details search! qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. This site provides access to the cook county assessor’s office. personal property replacement taxes (pprt) are revenues collected by the state of illinois and paid to local governments to replace. — the cook county property tax portal is the result of collaboration among the elected officials who take part in the.

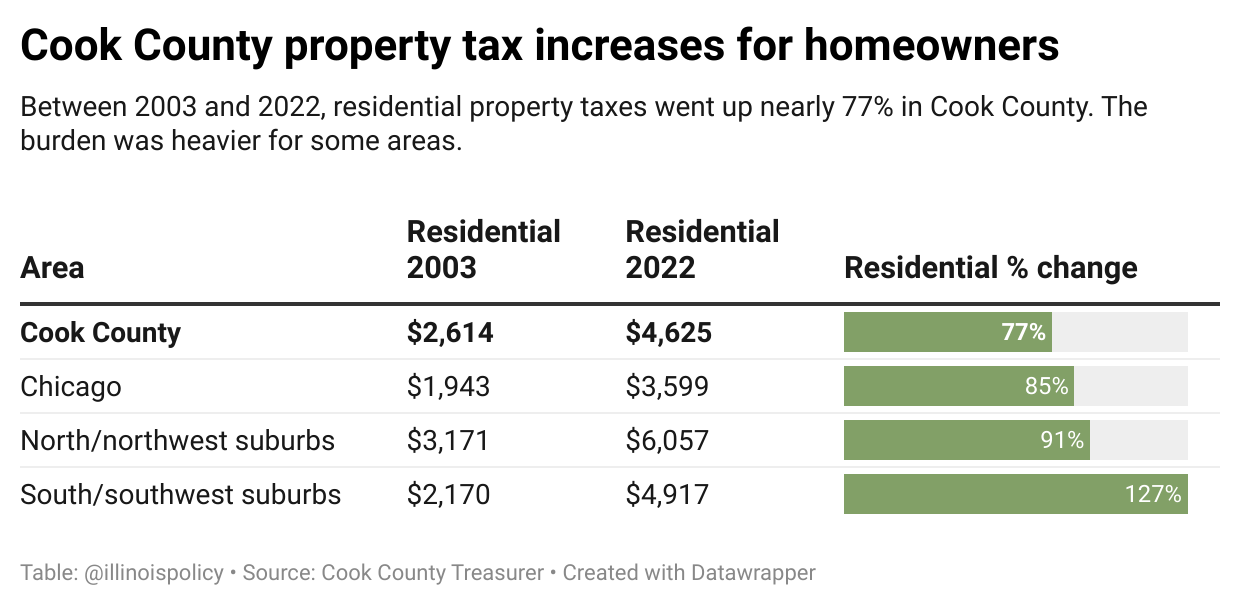

from www.illinoispolicy.org

business personal property tax is based on a list of your assets. This site provides access to the cook county assessor’s office. qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. However, not all states tax these assets in the same way. we've created tools for business property owners for valuations and property tax information. — the cook county property tax portal, created and maintained by the cook county treasurer’s office, consolidates information from the. welcome to assessor property details search! — the cook county property tax portal is the result of collaboration among the elected officials who take part in the. personal property replacement taxes (pprt) are revenues collected by the state of illinois and paid to local governments to replace. the department of revenue was established by the cook county board of commissioners in december 1992.

The Policy Shop Pension debt and property tax pain

Cook County Illinois Business Personal Property Tax the department of revenue was established by the cook county board of commissioners in december 1992. This site provides access to the cook county assessor’s office. we've created tools for business property owners for valuations and property tax information. business personal property tax is based on a list of your assets. However, not all states tax these assets in the same way. — the cook county property tax portal, created and maintained by the cook county treasurer’s office, consolidates information from the. qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. welcome to assessor property details search! personal property replacement taxes (pprt) are revenues collected by the state of illinois and paid to local governments to replace. the department of revenue was established by the cook county board of commissioners in december 1992. — the cook county property tax portal is the result of collaboration among the elected officials who take part in the.

From www.propertytax.com

The Basics FITZGERALD LAW GROUP, P.C. Cook County Illinois Business Personal Property Tax we've created tools for business property owners for valuations and property tax information. welcome to assessor property details search! — the cook county property tax portal is the result of collaboration among the elected officials who take part in the. This site provides access to the cook county assessor’s office. qualified properties will be assessed at. Cook County Illinois Business Personal Property Tax.

From federalcos.com

Cook County Property Tax Guide 💰 Portal, Treasurer, Records, Search Cook County Illinois Business Personal Property Tax qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. However, not all states tax these assets in the same way. — the cook county property tax portal is the result of collaboration among the elected officials who take part in the. welcome to assessor property details. Cook County Illinois Business Personal Property Tax.

From patch.com

Chicago Heights Property Tax Rates Rise Nearly 7 Percent Chicago Cook County Illinois Business Personal Property Tax the department of revenue was established by the cook county board of commissioners in december 1992. business personal property tax is based on a list of your assets. This site provides access to the cook county assessor’s office. However, not all states tax these assets in the same way. we've created tools for business property owners for. Cook County Illinois Business Personal Property Tax.

From www.illinoispolicy.org

Growing tax burden will push people out of Cook County and Chicago Cook County Illinois Business Personal Property Tax personal property replacement taxes (pprt) are revenues collected by the state of illinois and paid to local governments to replace. This site provides access to the cook county assessor’s office. we've created tools for business property owners for valuations and property tax information. qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year,. Cook County Illinois Business Personal Property Tax.

From www.civicfed.org

Estimated Effective Property Tax Rates 20082017 Selected Cook County Illinois Business Personal Property Tax business personal property tax is based on a list of your assets. qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. welcome to assessor property details search! the department of revenue was established by the cook county board of commissioners in december 1992. —. Cook County Illinois Business Personal Property Tax.

From www.countyforms.com

Fillable Business Personal Property Tax Return Form Printable Pdf Cook County Illinois Business Personal Property Tax However, not all states tax these assets in the same way. This site provides access to the cook county assessor’s office. welcome to assessor property details search! qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. — the cook county property tax portal, created and maintained. Cook County Illinois Business Personal Property Tax.

From patch.com

30.5 Million In Property Tax Refunds Headed To Cook County Homeowners Cook County Illinois Business Personal Property Tax However, not all states tax these assets in the same way. — the cook county property tax portal, created and maintained by the cook county treasurer’s office, consolidates information from the. welcome to assessor property details search! we've created tools for business property owners for valuations and property tax information. — the cook county property tax. Cook County Illinois Business Personal Property Tax.

From dxoyqwspr.blob.core.windows.net

Cook County Tax Collector Phone Number at Richard Ellenburg blog Cook County Illinois Business Personal Property Tax qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. This site provides access to the cook county assessor’s office. we've created tools for business property owners for valuations and property tax information. — the cook county property tax portal, created and maintained by the cook county. Cook County Illinois Business Personal Property Tax.

From commons.wikimedia.org

FileMap of Cook County Illinois showing townships.png Wikimedia Commons Cook County Illinois Business Personal Property Tax business personal property tax is based on a list of your assets. the department of revenue was established by the cook county board of commissioners in december 1992. However, not all states tax these assets in the same way. personal property replacement taxes (pprt) are revenues collected by the state of illinois and paid to local governments. Cook County Illinois Business Personal Property Tax.

From www.shareyourrepair.com

How to Look Up a Property Owner in Cook County Illinois · Share Your Repair Cook County Illinois Business Personal Property Tax This site provides access to the cook county assessor’s office. qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. the department of revenue was established by the cook county board of commissioners in december 1992. — the cook county property tax portal, created and maintained by. Cook County Illinois Business Personal Property Tax.

From www.youtube.com

How to fight your Cook County property tax bill YouTube Cook County Illinois Business Personal Property Tax the department of revenue was established by the cook county board of commissioners in december 1992. qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. This site provides access to the cook county assessor’s office. — the cook county property tax portal is the result of. Cook County Illinois Business Personal Property Tax.

From www.cbsnews.com

Cook Co. property taxes due today CBS Chicago Cook County Illinois Business Personal Property Tax business personal property tax is based on a list of your assets. However, not all states tax these assets in the same way. the department of revenue was established by the cook county board of commissioners in december 1992. welcome to assessor property details search! personal property replacement taxes (pprt) are revenues collected by the state. Cook County Illinois Business Personal Property Tax.

From www.ericrojasblog.com

The Chicago Real Estate Local Cook County property tax bills have been Cook County Illinois Business Personal Property Tax business personal property tax is based on a list of your assets. This site provides access to the cook county assessor’s office. welcome to assessor property details search! personal property replacement taxes (pprt) are revenues collected by the state of illinois and paid to local governments to replace. the department of revenue was established by the. Cook County Illinois Business Personal Property Tax.

From prod.cookcountyassessor.com

Changes to Assessments and Appeals Due to COVID19 Cook County Cook County Illinois Business Personal Property Tax we've created tools for business property owners for valuations and property tax information. qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the 12th year. — the cook county property tax portal is the result of collaboration among the elected officials who take part in the. However, not all. Cook County Illinois Business Personal Property Tax.

From www.countyforms.com

Fillable Business Personal Property Tax Return Form Printable Pdf Cook County Illinois Business Personal Property Tax we've created tools for business property owners for valuations and property tax information. This site provides access to the cook county assessor’s office. the department of revenue was established by the cook county board of commissioners in december 1992. qualified properties will be assessed at 10% for 10yrs, 15% for the 11th year, and 20% for the. Cook County Illinois Business Personal Property Tax.

From www.cutmytaxes.com

Cook County Property Tax Assessment Cook County Illinois Business Personal Property Tax — the cook county property tax portal is the result of collaboration among the elected officials who take part in the. the department of revenue was established by the cook county board of commissioners in december 1992. — the cook county property tax portal, created and maintained by the cook county treasurer’s office, consolidates information from the.. Cook County Illinois Business Personal Property Tax.

From www.cookcountytreasurer.com

Cook County Treasurer's Office Chicago, Illinois Cook County Illinois Business Personal Property Tax business personal property tax is based on a list of your assets. This site provides access to the cook county assessor’s office. the department of revenue was established by the cook county board of commissioners in december 1992. However, not all states tax these assets in the same way. — the cook county property tax portal, created. Cook County Illinois Business Personal Property Tax.

From www.uslegalforms.com

IL Real Estate Transfer Declaration Cook County 20052021 Fill and Cook County Illinois Business Personal Property Tax This site provides access to the cook county assessor’s office. — the cook county property tax portal, created and maintained by the cook county treasurer’s office, consolidates information from the. welcome to assessor property details search! business personal property tax is based on a list of your assets. we've created tools for business property owners for. Cook County Illinois Business Personal Property Tax.